An e-PAN card is therefore an online version of the physical PAN card which is issued by the Income Tax Department. This document is used as an identification tool recommending any type of monetary operation. The e-PAN has the added advantage of being able to be stored digitally, not on a physical card like its counterpart, the ATM card.

While, in this blog, we’ll discuss the following topics: eligibility criteria for online PAN download from the NSDL, UTIITSL or the Income Tax website, and the ways to download an e-PAN without PAN Number. We shall also attempt to address some of the frequently asked questions with regard to this process in other to enhance your understanding.

If you want to resize your document and photos then visit – https://pancardresizer.in/

Eligibility for e-PAN Card

Before diving into the download process, let’s look at the basic eligibility requirements:

- Citizenship: Only individual citizens are eligible.

- Aadhaar Linkage: Aadhaar card must be linked to your mobile number.

- Valid Mobile Number: Your mobile number should be active to receive OTPs during the process.

How to Download e-PAN Card?

Once your e-PAN application is processed, you can download it from the respective platform where you applied. Below are the methods for downloading your e-PAN card from various portals.

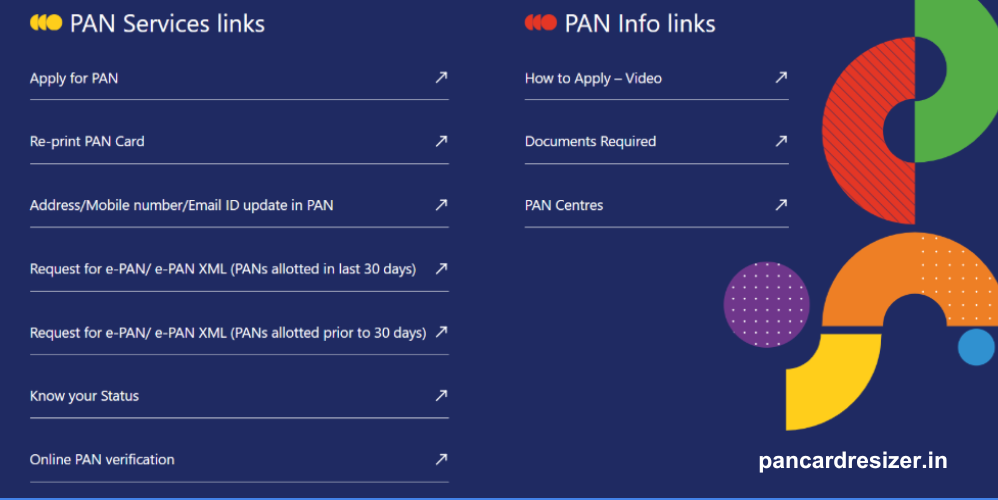

1. Download e-PAN from NSDL

If you applied for your e-PAN on the NSDL (Protean) portal, follow these steps:

Visit the NSDL Portal:

Navigate to the NSDL e-PAN services page.

Select the Appropriate Option:

Choose either ‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’ or ‘Download e-PAN/e-PAN XML (PANs allotted before 30 days)’.

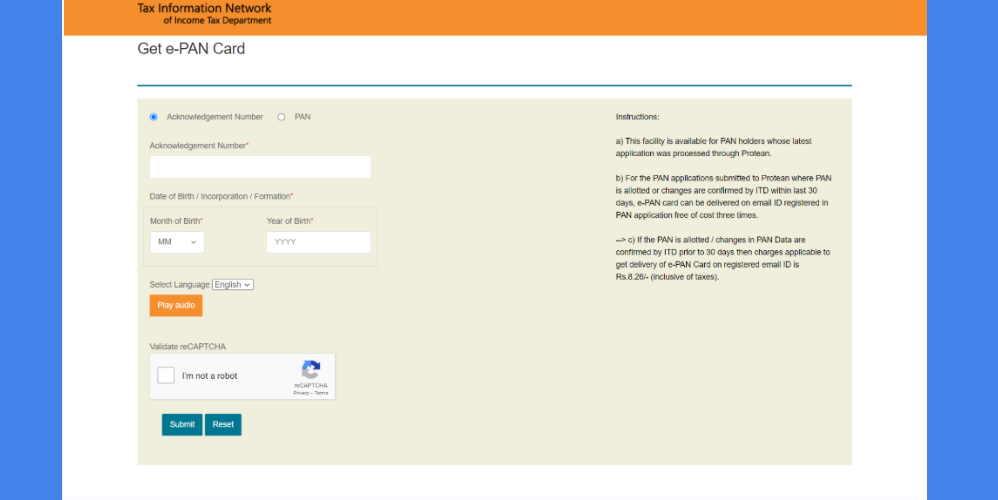

Provide Details:

Choose the Acknowledgement Number option.

Enter your acknowledgement number, date of birth, and the captcha code.

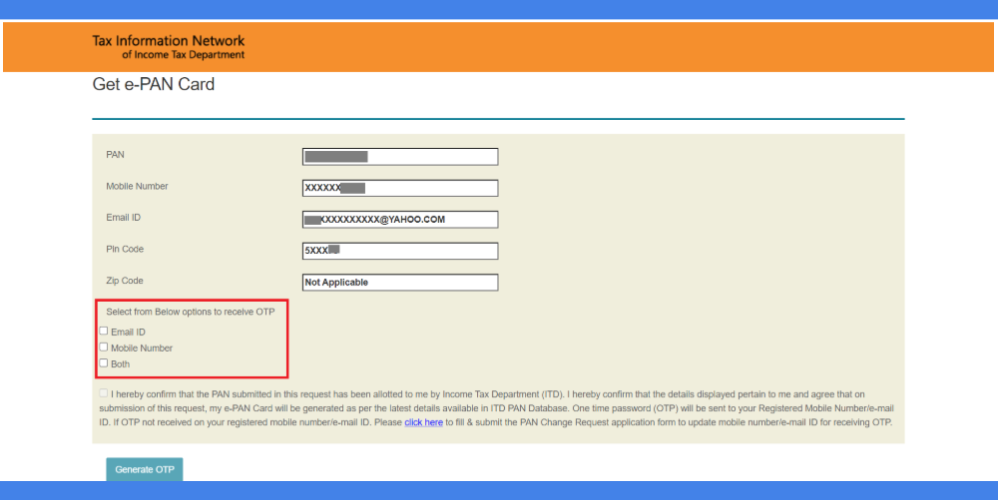

Validate OTP:

Select the mode to receive the OTP (email, mobile, or both).

Enter the OTP and click Validate.

Download e-PAN:

If you’re downloading the e-PAN within 30 days of its issuance, it’s free.

Post 30 days, you’ll need to pay a nominal fee of ₹8.26 to download the e-PAN card.

Access the PDF:

Download the e-PAN PDF file and unlock it using your date of birth as the password (DDMMYYYY).

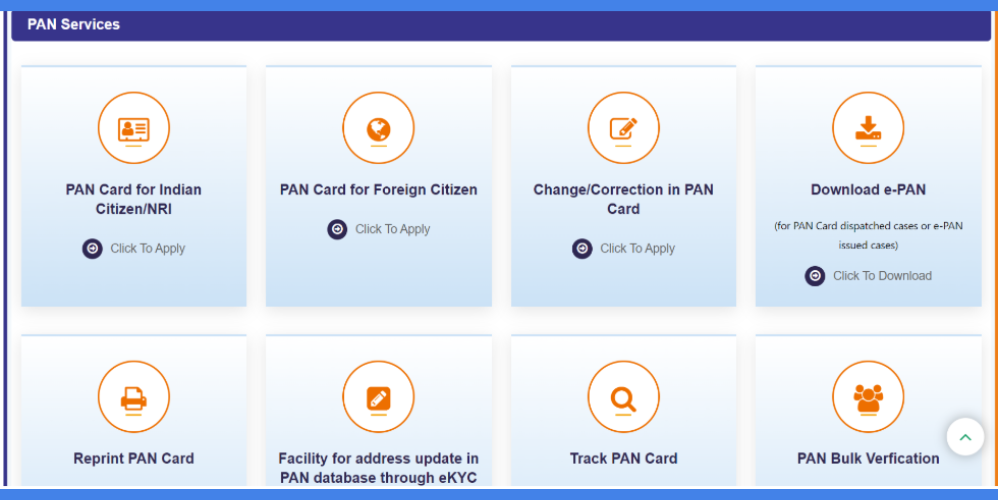

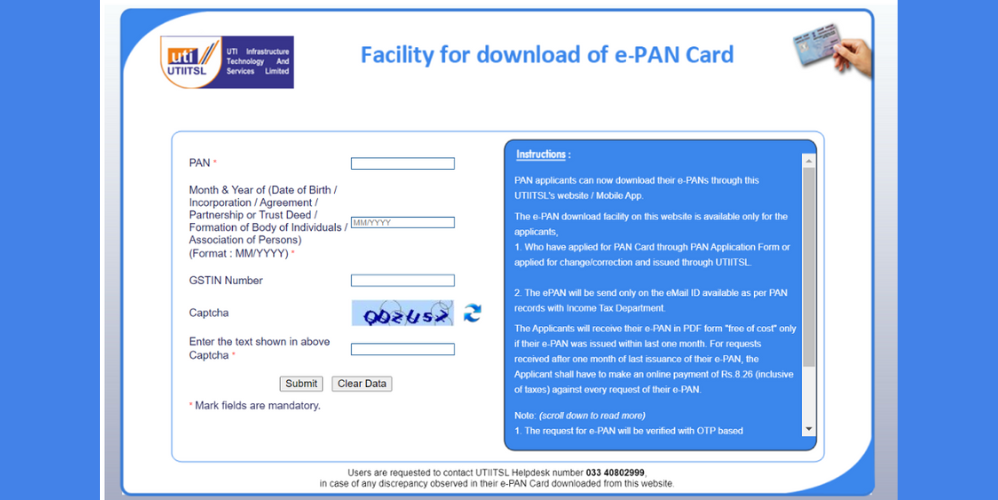

2. Download e-PAN from UTIITSL

For applicants who used the UTIITSL portal, here’s how you can download your e-PAN:

Visit the UTIITSL Website:

Go to the UTIITSL e-PAN services page.

Click on ‘Download e-PAN’:

On the homepage, find and click the ‘Click to Download’ option.

Enter Required Details:

Provide your PAN number, date of birth, GSTIN (if applicable), and captcha code.

Validate via OTP:

A download link will be sent to your registered email ID and download your e-pan.

Click the link and verify using the OTP to download the e-PAN.

Payment for Late Downloads:

Downloads within 30 days are free.

Beyond 30 days, a fee of ₹8.26 is applicable.

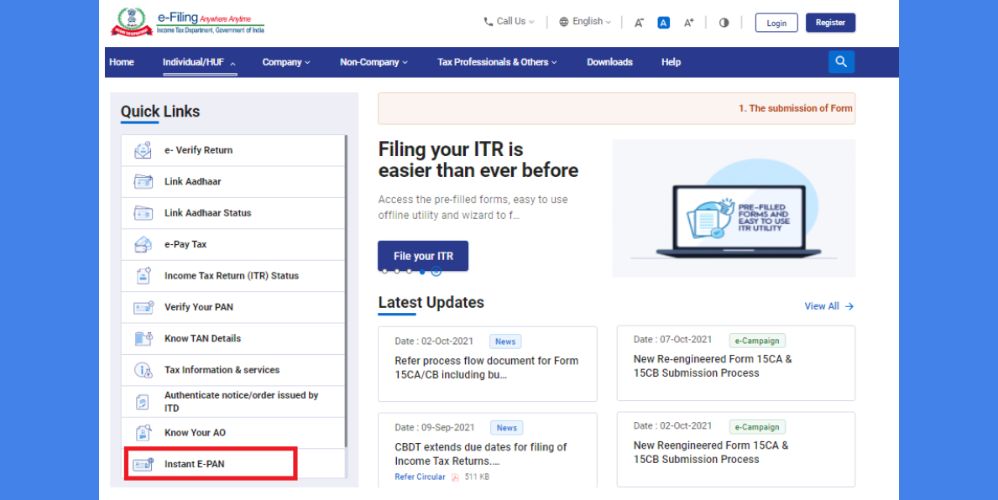

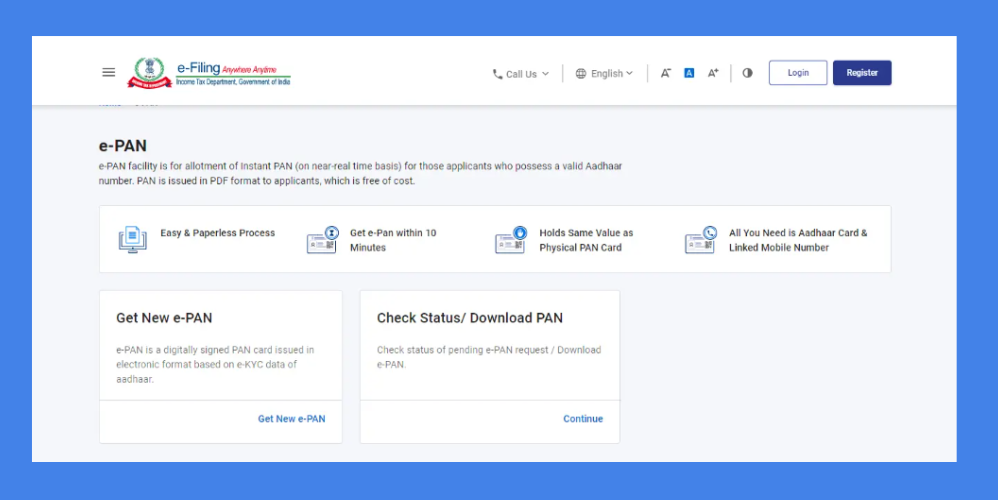

3. Download e-PAN from the Income Tax Website

For instant e-PAN applicants, the Income Tax website provides a quick download method:

Visit the e-Filing Portal:

Navigate to the Income Tax e-Filing portal.

Select ‘Instant e-PAN’:

Under the Quick Links section, choose ‘Instant e-PAN’.

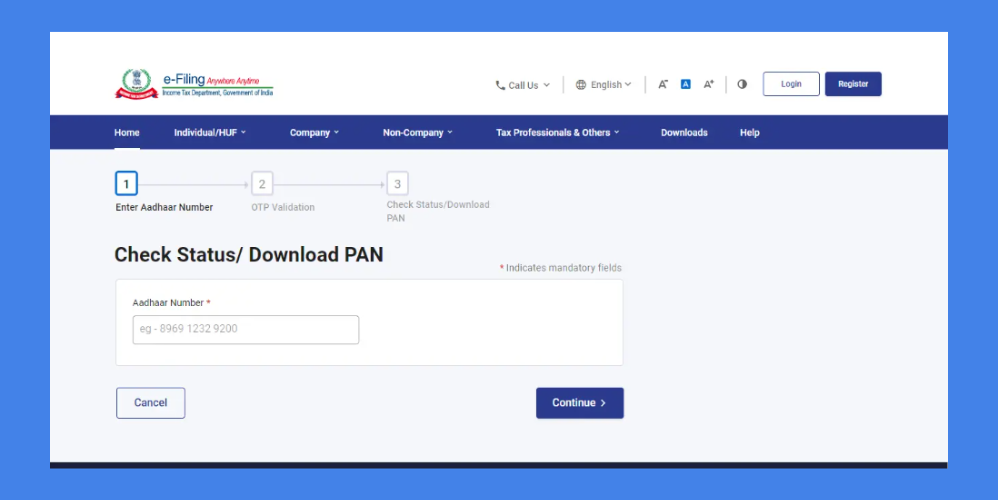

Check Status:

Click on ‘Check Status/Download PAN’.

Enter Aadhaar Details:

Provide your Aadhaar number and click Continue.

Validate via OTP:

Enter the OTP sent to your Aadhaar-linked mobile number and complete the process.

Download e-PAN:

Click on the ‘Download e-PAN’ button to get your digital PAN.

How to Download e-PAN Without PAN Number?

Lost your PAN number? Don’t worry; you can still download your e-PAN if you applied on the NSDL or Income Tax portal:

- Via NSDL Portal:

- Use your acknowledgment number instead of the PAN number.

- Follow the same steps as described above for the NSDL portal.

- Via Income Tax Portal:

- Provide your Aadhaar number.

- Validate via OTP and download the e-PAN.

How to Download e-PAN with PAN Number?

If you know your PAN number, you can directly download your e-PAN from any portal:

- NSDL/UTIITSL Portal:

- Enter your PAN number, date of birth, and other details.

- Validate the OTP to access your e-PAN.

- Income Tax Portal:

- Provide your Aadhaar-linked PAN number.

- Download it instantly after OTP verification.

e-PAN Card Password

The downloaded e-PAN PDF is password-protected. The password is your date of birth (DDMMYYYY format) or the date of incorporation for businesses.

Conclusion

Being an e-PAN the option of downloading it is very easy and without involving much fuss. Whether you applied through NSDL or through UTIITSL or through Income tax website, all you need is the acknowledgement number or PAN number or Aadhaar number. This is mainly because the e-PAN is a digital version of the physical PAN cards and can be downloaded for free within 30 days after generation.

Don’t panic, just use your e-PAN wisely and make the process of digital identity as relaxed as possible.

FAQ – Frequently Asked Question

How can I download my e-PAN card online?

You can download your e-PAN from the NSDL, UTIITSL, or Income Tax portal using your PAN number, acknowledgment number, or Aadhaar number.

Is it possible to download a PAN card without an OTP?

No, OTP verification is mandatory to ensure security during the download process.

Can I get my e-PAN for free?

Yes, e-PAN is free if downloaded within 30 days of its issuance. After that, a nominal fee applies.

What is the validity of the e-PAN card?

The e-PAN card is valid indefinitely, just like the physical PAN card.

How do I unlock my e-PAN PDF file?

Use your date of birth (DDMMYYYY format) as the password to unlock the e-PAN file.